4 Simple Techniques For Chapter 13 Discharge Papers

Table of ContentsObtaining Copy Of Bankruptcy Discharge Papers - An OverviewNot known Facts About Chapter 13 Discharge PapersThe 15-Second Trick For Copy Of Bankruptcy DischargeThe smart Trick of How Do I Get A Copy Of Bankruptcy Discharge Papers That Nobody is Talking AboutCopy Of Chapter 7 Discharge Papers for Dummies

Attorney's are not needed to maintain bankruptcy filings."Free Personal Bankruptcy Documents"A. All Company and also Business Files, might be bought by calling the U.S.A. Bankruptcy records insolvency to utilize kept indefinitely until Forever. Laws have actually now altered to maintain insolvency files for just 20 years - https://www.railsroot.com/profiles/71703-robert-ingram.

If you submitted bankruptcy in 2004 or prior, your documents are limited, and may not be available to buy digitally. Telephone Call (800) 988-2448 to inspect the schedule prior to buying your documents, if this uses to you.

An Unbiased View of Chapter 13 Discharge Papers

U.S. Records charge's to help in the access procedure of obtaining insolvency documents from NARA, relies on the time engaged and also price included for united state Records, plus NARA's costs The Docket is a register of basic information during the personal bankruptcy. Such as condition, instance number, declaring and discharges days, Lawyer & Trustee info.

If you're late paying the tax obligation, keep the return 2 years from the day you paid or three from when you filed (whichever is later on). When it pertains to invoices, if there's a service warranty, keep the invoice until the warranty goes out. Otherwise, for anything you might need to take back, simply maintain the invoice up until the return duration is up.

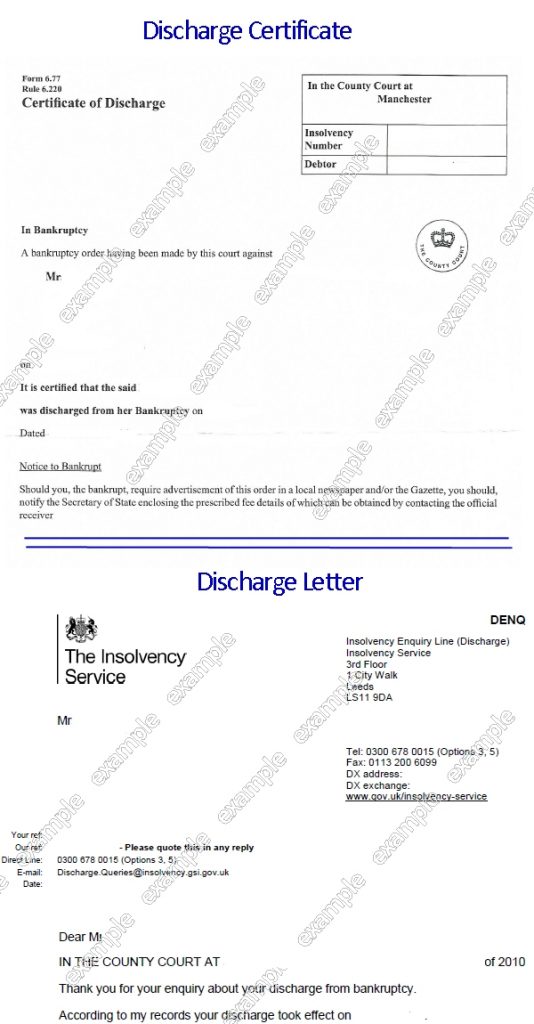

Despite the fact that your bankruptcy application, files, and discharge feel like financial records that might fall under the exact same timeline as your tax obligation docs, they are NOT (how do you get a copy of your bankruptcy discharge papers). They are even more vital and also need to be maintained forever. Creditors may come back and try to collect on a financial obligation that became part of the personal bankruptcy.

7 Simple Techniques For Copy Of Chapter 7 Discharge Papers

Creditors sell off poor debt in portions of thousands (or hundreds of thousands) of accounts. Bad financial obligation buyers are often aggressive and underhanded, and also having your bankruptcy records on-hand can be the fastest site way to close them down as well as maintain old things from standing out back up on your debt report.

Having licensed copies of your documentation can avoid a hold-up in your licensure. The brief answer? Every one of them. Getting copies of your personal bankruptcy documents from your legal representative can take time, especially if your case is older and the duplicates are archived off-site. Obtaining insolvency papers from the Federal courts can be costly as well as taxing also (https://bom.so/2WkuDv).

Get a box or big envelope and put them all within. Put them in a secure place, too like where you keep your will certainly and various other vital financial documents as well as simply leave them there.

5 Simple Techniques For How Do You Get A Copy Of Your Bankruptcy Discharge Papers

A discharged debt literally vanishes. It's no more collectible. The financial institution has to compose it off. Debts that are most likely to be released in a personal bankruptcy proceeding include debt card financial debts, medical expenses, some lawsuit judgments, individual car loans, responsibilities under a lease or various other agreement, and also various other unsafe debts - https://www.authorstream.com/b4nkrvptcydcp/. That might seem too excellent to be real, as well as there are undoubtedly some disadvantages.

You can not merely ask the bankruptcy court to discharge your financial obligations since you do not desire to pay them. You must finish all of the requirements for your insolvency case to obtain a discharge.

Personal bankruptcy Trustee, and also the trustee's lawyer. The trustee directly manages your personal bankruptcy instance.

Not known Details About Copy Of Bankruptcy Discharge

You can submit a motion with the insolvency court to have your instance resumed if any kind of financial institution tries to accumulate a released debt from you. The creditor can be fined if the court figures out that it went against the discharge injunction. You can attempt just sending out a copy of your order of discharge to stop any kind of collection task, and afterwards talk with a bankruptcy lawyer regarding taking lawsuit if that does not function.

Any type of financial obligation that remains will be released or eliminated. You'll enter into a payment strategy over three to 5 years that pays off all or most of your financial obligations if you file for Phase 13 defense.